Key Takeaways

- Distinguish storage from movement. Define each facility by its function. Amazon “warehouses” (storage pools) focus on inventory receipt and holding. Fulfillment Centers (FCs) and Distribution Centers (DCs) are designed for order processing, pick & pack, and shipping. Sortation and delivery stations optimize last-mile sequencing. For foundational distinctions, see educational overviews of warehouse and distribution centre roles.

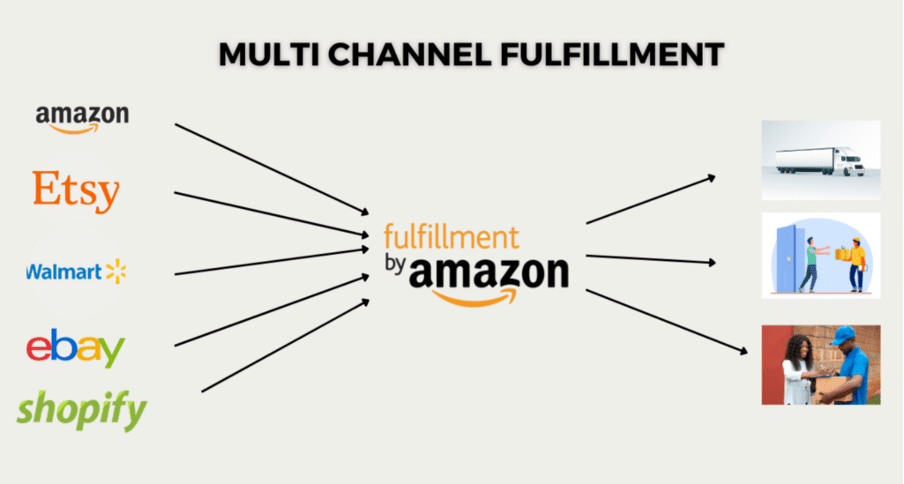

- Map Amazon facility types to services and fees. FBA manages end-to-end Amazon orders (storage + pick-pack + outbound fees + returns). MCF/FBM enable multi-channel fulfillment at Amazon rates. FC/DCs are Amazon’s core order processors, while sortation and delivery stations handle carrier handoffs. Each layer has distinct fee schedules and routing rules.

- Break down the true per-order cost components. Include inbound freight, receiving and prep, storage (time-weighted), pick-and-pack, packaging materials, outbound shipping, returns handling, removals/long-term storage, marketplace fees, and kitting/assembly costs.

- Quantify Amazon vs 3PL economics with landed cost per order. Compare the all-in cost (COGS + fulfillment + duties/VAT + last-mile), not just one-time charges. Amazon often wins on scale with simple SKUs; 3PLs can outperform on complex kits, custom packaging, and cross-border optimization.

- Use SKU-level models for decision-making, not averages. Model high-, mid-, and low-velocity SKUs separately. Dense, small SKUs often favor FBA for lower per-unit fees, while oversized or slow-movers can be more cost-effective through 3PL or DC consolidation due to long-term storage penalties.

- Factor cross-border/domestication into inventory strategy. Domesticating inventory (local fulfillment footprint) reduces transit times, duties, and returns friction, but it increases safety stock and carrying costs. Always model the trade-off between landed cost savings and higher working capital.

- Prioritize control and brand experience when selecting 3PL vs Amazon. Choose 3PLs for custom packaging, inserts, subscription/boxed experiences, or seller-controlled returns. Lean on Amazon when speed, Prime SLAs, and Buy Box competitiveness are more important.

- Account for hidden costs in Amazon ecosystems. Include inbound routing compliance fees, commingling risk, removal lead times, and packaging limitations. These factors often push mid-market brands toward hybrid or 3PL solutions.

- Adopt a hybrid fulfillment strategy for cross-border growth. Split SKUs by role: use Amazon FBA for high-velocity domestic SKUs, 3PLs or domestic DCs for regulated, high-margin, or brand-sensitive SKUs, and MCF for multi-channel consolidation to balance costs and lead times.

- Follow a structured vendor-selection checklist. Evaluate SLAs (OTD, accuracy), cost transparency (line-item TCO), cross-border expertise (domestication, VAT/duties), tech integrations (API, inventory visibility), scalability, warehousing footprint, returns processing, and references for similar SKU profiles.

- Run scenario-based cost comparisons before committing. Build 12–24 month TCO scenarios (orders/day, SKU mix, return rate, inventory days) comparing FBA-only, 3PL-only, and hybrid strategies. Stress-test for peak season surges and cross-border disruptions.

- Leverage Evolution Fulfillment’s Brand Fulfillment Model as a blueprint. A branded, centralized 3PL layer can integrate with Amazon (MCF/FBA) to retain packaging and control, manage domestic inventory pools, and optimize cross-border domestication—ideal for mid-market brands scaling internationally.

What’s the difference between Amazon warehouse and fulfillment center and why should a mid-market brand care? A single routing decision (FBA vs a domestic 3PL or DC) can shift landed cost per order, service levels, and return experience. For seasonal or high‑margin SKUs, this swing can make or break your margin.

At Evolution Fulfillment, we build models that tie facility function to cost drivers. In this deep dive, we define storage versus movement, map Amazon facility types (FBA, MCF/FBM, FC, DC, sortation/delivery stations) to services and fees, break down per-order cost components, and show SKU‑level TCO models. You’ll get a practical decision framework, a vendor‑selection checklist, and our hybrid blueprint for domestic and cross‑border growth.

Key Takeaways Mid-Market Brands Should Internalize

- Don’t conflate facilities. Warehouses primarily store inventory, while Fulfillment Centers (FCs) and Distribution Centers (DCs) are designed to move product—picking, packing, and shipping. Sortation and delivery stations focus on last-mile sequencing. Fees accrue where the work happens. For fundamentals, see BCIT’s overview of warehouses vs distribution centres.

- Model the full fee stack. Factor in inbound freight, receiving and prep, time-weighted storage, pick/pack, packaging, outbound shipping and DIM charges, returns processing, removals or aged-inventory surcharges, software/integration, account management, and marketplace/platform fees.

- Remember: storage ≠ fulfillment. Storage costs are time-based, while fulfillment costs are activity-based. Your cost model should allocate each separately to get a true picture of profitability.

- Cross-border can make or break landed cost per order (LCO). Duties, VAT, brokerage, Importer/Exporter of Record (IOR/EOR) requirements, DDP vs DDU shipping, linehaul costs, and extra dwell days often outweigh postage savings.

- Balance control vs speed. Amazon excels at postage density, Prime SLAs, and small/standard items. 3PLs shine with branded packaging, kitting, oversized or fragile products, regulated SKUs, and better returns control.

- Hybrid strategies usually win. Use FBA for high-velocity Prime-native SKUs, MCF for non-Amazon channels where speed matters, and 3PL/DC setups for brand experience, wholesale/B2B, and cross-border domestication.

- Stay aware of the 2026 fee landscape. Watch for Q4 peak storage multipliers (Oct–Dec), aged-inventory surcharges (181/271/365+ days), low-inventory-level fees (standard-size SKUs), and changes in removal/return processing fees and MCF service-level pricing.

- Validate rates monthly. Amazon’s fee schedules and 3PL rate cards fluctuate by tier, region, and season. Always confirm against live rate cards before locking in decisions.

- Use a vendor checklist. Evaluate providers based on SLAs (on-time delivery, accuracy), accuracy rates, warehouse footprint, cross-border expertise, WMS/API maturity, references, and transparent total cost of ownership (TCO) modeling.

- Run scenario-based cost comparisons. Model 12–24 months of data (orders/day, SKU mix, return rate, inventory days) for FBA-only, 3PL-only, and hybrid setups. Stress-test for peak season volatility and cross-border disruptions before committing.

What’s the real cost difference between Amazon FBA and a third-party 3PL — and which model is right for your brand’s distribution strategy?

This guide is for business owners and brand managers making that decision. If you run a mid-market brand doing $5M–$20M in annual sales and you’re weighing Amazon FBA against an independent fulfillment partner, you’re in the right place. We model the full landed cost per order: storage, pick-and-pack, cross-border duties, returns, and every hidden fee in between.

Canadian brands using Amazon FBA as part of a multi-channel strategy will find the cross-border and domestication analysis particularly useful — it’s one of the most misunderstood cost drivers in the Canada-US corridor.

If you want to see transparent 3PL pricing side-by-side with Amazon’s published FBA rates, we’ve included real per-order ranges for both models throughout, including a breakdown of where each wins by SKU type.

At Evolution Fulfillment, we build cost models that tie facility function to actual fee drivers. In this deep dive: we define storage vs movement, map Amazon facility types (FBA, MCF/FBM, FC, DC, sortation and delivery stations) to their fees, break down per-order landed cost components, and show SKU-level TCO comparisons across three real-world scenarios. You’ll get a decision framework, a vendor-selection checklist, and our hybrid fulfillment blueprint for domestic and cross-border growth.

Ready to compare your options with real numbers? Get a custom fulfillment quote and we’ll model your actual SKUs — not industry averages.

Facility-by-Function: Storage vs Movement

Not all facilities are created equal warehouses and DCs are designed to hold and move inventory in bulk (pallets or cases), while fulfillment centers (FCs) specialize in breaking inventory down into orders (eaches, kits) under strict SLAs. On the tail end, sortation and delivery stations sequence parcels for efficient carrier handoff.

The Cost Drivers Split in Two

- Storage is time-weighted. You’re charged based on how long goods sit in a space. For example, a standard bin of 0.7 ft³ at $1.00/ft³/month costs about $0.70/month, while a pallet ($22–$35/month) spreads cost over all units it holds.

- Movement is event-priced. Every action—receiving, picking, packaging, and outbound shipping—incurs per-unit fees. A typical structure might be $2.70 for the first pick + $0.45 per additional item. Factor in DIM-based postage, and packaging choice (box vs. mailer) can swing costs by $3 or more per order.

Why We Separate Them

At Evolution Fulfillment, we separate storage and movement into different cost centers. This prevents overhead from “hiding” labor and transport costs, ensuring each SKU gets an honest, activity-based allocation. That clarity helps brands see where their margin is really going—and make smarter decisions about SKU placement and packaging.

Amazon Network 101: FC, DC, Sortation, and Delivery Stations

Amazon’s logistics network is layered, with each type of facility serving a distinct role. Understanding these functions helps brands map services to fees and see exactly where costs accrue.

Fulfillment Center (FC)

This is the engine of Amazon fulfillment, where individual units (eaches, kits) are picked, packed, and shipped for FBA and MCF.

- Fees vary by size tier (small, standard, oversize, special handling).

- Prep, labeling, and accurate dimensions are critical. Even the packaging choice (envelope vs. box) can swing costs.

Distribution/Receive Center (DC)

Acts as Amazon’s inbound gateway.

- Receives shipments from vendors or 3PLs.

- Cross-docks inventory to FCs or holds reserve stock.

- Fees show up as inbound freight, placement/service fees, and storage for buffer inventory.

Sortation Center

This is where parcels are consolidated and routed by region.

- Parcels are inducted into Amazon Logistics or partner carriers.

- Costs are embedded inside FBA/MCF outbound fees.

Delivery Station

The final staging point before orders reach the customer.

- Amazon couriers or third-party drivers pick up here.

- For FBM or 3PL shipments, you’ll see costs as carrier surcharges (residential, DAS, fuel).

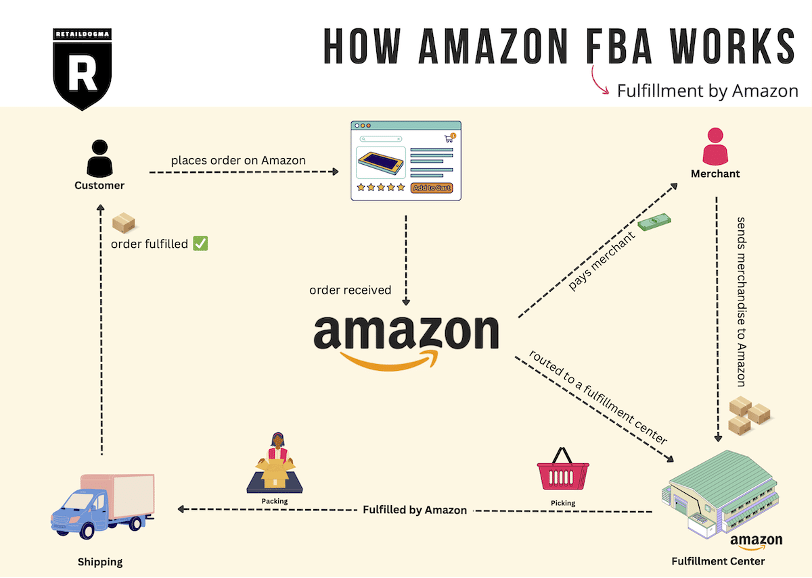

Channel Flows in Action

- • FBA: Vendor/3PL → DC → FC pick/pack → Sortation → Delivery.

- • MCF: Non-Amazon orders run through the same FC → Sortation → Delivery flow, but branding options are limited.

- • FBM: Seller or 3PL stores, picks, packs, and ships directly to carriers. Buy Box eligibility relies on SLA and price.

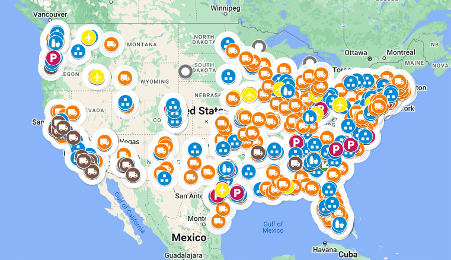

Map Amazon Facility Types to Services and Fees

FBA/MCF leverage FCs for pick/pack and storage, DCs for inbound placement, and Amazon Logistics (sortation/delivery) for last mile on eligible lanes. FBM bypasses Amazon’s FCs, using your 3PL/DC and third‑party carriers.

Fee mapping by activity:

- DC/Placement: Inbound freight and placement/service fees.

- FC Storage: Monthly $/ft³ with seasonality and aged-inventory surcharges.

- FC Fulfillment: Pick/pack and outbound by size/weight/DIM tiers; category-specific returns.

- Sortation/Delivery: Included in FBA/MCF outbound; in FBM, appears in parcel labels.

- Admin: Low-inventory-level fees (select standard-size SKUs), refunds/returns, removals, and disposal.

At Evolution Fulfillment, we keep this mapping live in your dashboards, so finance and ops see the same truth.

FBA (Fulfillment by Amazon)

FBA handles end-to-end for Amazon channel orders:

- Storage: Monthly $/ft³ with higher Oct–Dec multipliers. Validate your 2026 schedule by region. For example, a 10″×6″×4″ unit (0.14 ft³) at $1.00/ft³ costs ~$0.14 per unit per month.

- Fulfillment: Pick/pack/outbound priced by size/weight/DIM. A small standard at 8 oz may land in a lower bracket than a 1.2 lb unit that crosses a weight tier.

- Returns: Category-based processing. Apparel/footwear often incur per-return fees plus potential disposal if not restockable.

- Aged inventory: Surcharges after 181/271/365+ days escalate with cubic feet and age band.

- 2026 hotspots: Peak storage multipliers, low-inventory-level fees on standard-size, inventory placement/service fees, and higher removals during peak. Validate monthly updates.

- FBA wins on Prime-native velocity where postage density and 1–2-day SLAs monetize. Evolution Fulfillment helps clients plan coverage days to avoid low-inventory-level fees while protecting Buy Box.

MCF (Multi-Channel Fulfillment)

MCF uses Amazon FCs to fulfill non-Amazon orders:

- Rates vs FBA: Separate schedule by size/weight and service level (Standard, Expedited, Priority). Expect a ~$0.50–$2.50/order premium over FBA outbound for the same SKU.

- Branding/packaging: Ships in non-branded packaging with constraints—limited custom tissue, inserts, or gift wrap at scale.

- Integration/API: Reliable native apps and Order Routing APIs. Manage address validation and holds to avoid mis-picks.

- When to prefer MCF vs 3PL: MCF can beat 3PLs on small/standard parcels in 2-day footprints when you lack carrier discounts. If you require custom packaging or high insert complexity, a 3PL often wins.

Evolution Fulfillment frequently pairs MCF for DTC speed with our branded 3PL flows for gifting and subscription experiences.

FBM and Seller-Operated/3PL Fulfillment

FBM relies on the seller or 3PL to meet Amazon SLAs:

- SLAs/Buy Box: On-time delivery, valid tracking, and price competitiveness drive Buy Box share. Missing 2-day promises in key metros depresses conversion.

- Tracking/compliance: Maintain 98–99% on-time and <1% defect rates for safety.

- Cost/control advantages: Oversize, fragile, hazmat, or kitting-intensive products often favor a 3PL.

Evolution Fulfillment helps brands hit FBM SLAs with custom packaging, serial/lot capture, and negotiated carrier programs that reduce all-in costs on non-standard items.

Sortation/Delivery Stations and Carrier Handoffs

Linehaul ends at sortation; last-mile begins at delivery stations:

- Who pays: In FBA/MCF, outbound rates are all-in for these legs. In FBM/3PL, you pay carrier labels with fuel, DAS, and residential surcharges itemized.

- Fee visibility: Amazon embeds sortation; 3PL invoices show parcel cost + surcharges. Your WMS should map these to LCO.

- DIM example: A 14″×10″×8″ carton at 1.8 lb actual but 7.0 lb DIM jumps to Zone 6 DIM pricing. Right-sizing or switching to a poly at 0.9 lb actual can cut $3–$5 per order. For a neutral definition of chargeable dimensional (volumetric) weight, see IATA’s air cargo tariffs and rules overview.

Evolution Fulfillment’s cartonization engine auto-selects the lowest-cost compliant packaging to avoid DIM surprises.

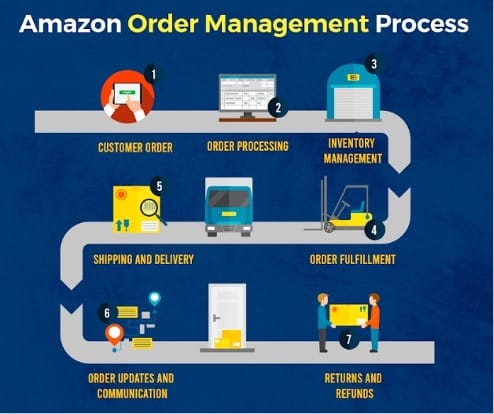

Operational Workflows: Receiving, Storage, Pick & Pack, Returns

Every stage of the fulfillment process, receiving, storage, pick/pack, and returns adds both time and cost. Managing these steps with clear SOPs (standard operating procedures) prevents chargebacks, keeps costs predictable, and protects cash flow.

Inbound Compliance and Prep

The receiving stage sets the tone for the rest of the process. Errors here ripple downstream into higher costs and delays.

- ASNs and labels: Incorrect purchase order (PO) or advance shipment notice (ASN) mapping—or missing SSCC/GTIN labels—triggers non-compliance penalties. For barcode/labeling best practices, see the GS1 Canada distribution centre guideline.

- Carton/pallet routing: Appointment windows, pallet height/weight caps, and floor-load rules must be followed to avoid dwell time charges.

- Prep rules: Poly-bag suffocation warnings, bubble wrap, barcode placement, and label coverage all affect compliance. Outsourcing FNSKU labeling costs more per unit, but during peak season it often preserves throughput.

- Penalties and dwell: Non-scannable barcodes, mixed SKUs in a carton, or unannounced overages trigger manual handling billed at hourly rates.

- SOPs: Pack-to-spec checklists, cartonization manifests, barcode validation, pre-ship audits, and prebooked appointments reduce risk.

At Evolution Fulfillment, we enforce a pre-receipt audit that catches inbound errors before stock hits the dock—shortening dock-to-stock time and preventing costly defects.

Storage and Time-Weighted Inventory Costs

- Inventory carrying cost grows with every extra day in storage. Understanding the tiers and timing is key:

- Tiers: Standard, oversize, or special-handling (hazmat/liquids). Each comes with its own rate card, often rising in Q4.

- Cubic-foot calculations: (L × W × H in inches ÷ 1728) = ft³. Multiply by $/ft³ and the months stored.

- Aged thresholds: Surcharges at 181/271/365 days often exceed base storage rates.

- Buffer vs. safety stock: More days on hand increase exposure to aged fees.

- Seasonality: Pre-staging in upstream DCs or bonded warehouses can help you avoid costly in-season FC storage.

We calibrate reorder points by node, so brands don’t end up paying Q4 storage rates for SKUs that move slowly.

Pick-Pack and Packaging Standards

- Packaging is where accuracy, costs, and brand experience intersect.

- Envelope vs. box: Small changes in dimensions can shift DIM weight and affect shipping cost brackets. Inserts and dunnage add ounces that tip parcels into higher fee ranges.

- Amazon vs. 3PL: Amazon optimizes for protection and speed; 3PLs enable customization, kitting, and branded unboxing.

- Sustainability: Right-sized, recyclable mailers can lower both cost and emissions, sometimes dropping a SKU into a cheaper weight class.

- Accuracy and SLAs: Always compare pick/pack fees against Amazon’s embedded fulfillment fees on a true apples-to-apples basis.

At Evolution Fulfillment, we run packaging trials to balance cost savings with damage prevention, ensuring lower landed costs without risking SLA performance.

Returns, Removals, and Dispositions

- Returns and removals don’t just affect customer experience—they directly shape your cash flow and margins.

- Returns intake: Amazon charges category-based fees, while 3PLs typically price per RMA plus grading.

- Grading/resell: Define clear A/B/C grading criteria and refurbishment rules to recover as much value as possible.

- Removals: FBA removal/disposal fees rise during peak and may take weeks to complete. Inventory continues accruing storage fees until it exits the FC.

- Timelines: Plan removals proactively to avoid aged surcharges.

- Liquidation/donation: Weigh the recovery value from liquidation markets against carrying costs—or use donation programs to minimize loss.

Our returns team accelerates refurbishment and funnels inventory back into the most profitable resale or donation path.

Cost Model Foundations: What to Include Per Order

Per-order modeling must combine activity-based costs and time-based storage into a single LCO. Go beyond headline fees. Allocate software, integrations, and account management.

Evolution Fulfillment provides SKU‑level LCO dashboards, so finance can forecast and ops can act.

Landed Cost Per Order (LCO) Formula

LCO = Inbound Freight + Receiving/Prep + Placement/Labeling + Time-Weighted Storage + Pick/Pack Labor + Packaging Materials + Outbound Postage (incl. DIM/fuel) + Marketplace Fees (referral/MCF uplift) + Returns/Refund Reserve + Removals/Aged Surcharges (allocated) + Software/Integration + Account Management + Cross-Border (Duties/VAT/Brokerage) + Payment/Fintech Fees.

Components:

- Inbound freight: Allocate by units on the load.

- Receiving/prep: Include labeling and rework.

- Storage: ft³ × $/ft³ × months/12; add peak multipliers and aged bands.

- Pick/pack: First-pick + add-ons; or FBA/MCF per-unit fulfillment.

- Packaging: Materials at actual cost.

- Outbound: Zone/DIM with fuel.

- Marketplace fees: Referral rates; MCF premiums for faster service.

- Returns: Rate × cost per return.

- Removals/aged: Expected removals and surcharges allocated per unit.

- Cross-border: Duties/VAT, brokerage, DDP vs DDU.

- Overheads: WMS/OMS, integrations, account management.

- Payment: Gateway and settlement fees by channel.

For industry-standard definitions of total cost to serve and landed cost metrics, see ASCM’s Digital Capabilities Model references to Total Cost to Serve and Total Network Landed Cost

Variable vs Fixed Allocations

- Variable: Pick/pack, packaging, postage/DIM, returns processing, per-unit FBA/MCF fees, duties/VAT.

- Semi-variable: Receiving/prep, removals, aged inventory surcharges.

- Fixed/allocated: WMS/OMS/API, account management, BI/analytics.

- Peak surcharges: Holiday storage multipliers; carrier peak adders.

- DIM pricing: Manage with cartonization logic to auto-select mailers and avoid DIM jumps.

We separate these buckets so you can test scenarios without double-counting.

Amazon 2026 Fee Landscape: FBA and MCF

Amazon’s 2026 fulfillment fees continue to evolve. Expect sharper differentiation by size tier and weight bracket, heavier storage pressures in Q4, and more refined surcharges. Always validate against the live 2026 Amazon rate cards, since tiers and seasonality vary by region and can be updated mid-year.

FBA: Size Tiers, Weight Brackets, and Storage Seasons

- Tiers: Amazon fulfillment fees are based on four categories—small standard, standard, oversize, and special handling.

- Weight brackets: Crossing a threshold can add several dollars per order. For example, a SKU that shifts from 1.0 lb to 1.2 lb may jump into a higher bracket.

- Storage seasons: From October through December, multipliers often run 1.5×–2× higher than base rates.

Example: A 1.0 lb standard-size SKU held for 45 days may cost pennies in storage during the off-season, but face meaningful multipliers in Q4.

At Evolution Fulfillment, we stress-test packaging options early to help brands keep SKUs inside favorable weight brackets and storage tiers.

MCF: Rate Cards and Service Levels

Amazon’s Multi-Channel Fulfillment (MCF) program runs in parallel with FBA but applies a different fee structure.

- Service levels: Standard: 3–5 business days, Expedited: 2–3 business days, Priority: 2-day delivery

- Pricing: MCF carries a premium over FBA for the same SKU—typically $0.50–$2.50 per order more. The spread widens at higher shipping zones and during peak periods.

- Branding limits: MCF ships in non-branded packaging, which is fine for replenishment or commodity SKUs, but limiting for lifestyle, gifting, and subscription experiences.

- Integration: Route only eligible SKUs into MCF. Complex kits, custom packaging, or high-insert products are better suited to your 3PL.

We route DTC orders dynamically between MCF and our 3PL operations based on margin and brand goals.

How Much Does 3rd-Party Fulfillment Cost in 2026? (3PL Pricing Ranges)

So, how much does 3rd-party fulfillment actually cost? The short answer: it depends on activity and postage. For mid-market brands, pricing is activity-based, and ranges vary by region, season, and volume. Think of the numbers below as directional benchmarks always confirm with live quotes before locking in.

Typical 3PL Line Items

Here’s what you can expect on a standard 3PL rate card:

- Setup/Implementation: $0–$5,000 one-time. Integrations run $0–$500 per connector. Onboarding: 2–6 weeks.

- Receiving: $35–$55/hour or $5–$12/pallet. Carton-level: $0.15–$0.40/carton. Labeling: $0.20–$0.40/unit.

- Storage: $15–$35/pallet/month, or $0.50–$1.20 per ft³. Bin storage: $1.00–$4.00/bin/month. Q4 surcharges are common.

- Pick/Pack: $2.00–$3.50 for the first pick; $0.25–$0.75 for each additional unit. Lot/serial capture: +$0.05–$0.15.

- Packaging: Mailers: $0.12–$0.30. Boxes: $0.35–$1.20. Dunnage: $0.05–$0.20. Branded packaging: cost + 5–15%.

- Inserts/Kitting: $0.10–$0.45 for simple inserts. Complex kitting/assembly: $40–$75/hour.

- Returns (RMA): $2.50–$5.00 per unit (basic QC included). Refurbishing: $0.50–$2.00.

- VAS (Value-Added Services): FBA prep, ticketing, GOH, compliance photos at $40–$85/hour.

- Account Management: $250–$1,000/month (sometimes bundled with reporting/BI).

- Postage: Carrier labels at negotiated rates. Markup: 0–10% or pass-through. Fuel/DAS/residential surcharges apply.

At Evolution Fulfillment, we quote transparent line items and build SKU-level models with you, so there are no surprises.

All-In Benchmarks by Order Profile

To make it more practical, here’s what all-in fulfillment + postage might look like:

- Small/light DTC (≤1 lb, 1–2 units): Ops $3.00–$5.50; Postage $4.50–$8.50 → $7.50–$14.00 all-in.

- Multicart (3–5 units): Ops $3.75–$7.00; Postage $6.50–$10.50 → $10.25–$17.50 all-in.

- Oversize/fragile (≥10 lb or large DIM): Ops $5.50–$12.00; Transport $12–$28 → $18–$40 all-in.

- Subscription/kitting: Ops $4.50–$8.50; Postage $4.50–$9.50 → $9.00–$18.00 all-in.

- Wholesale/B2B (case/pallet): Ops $20–$60; LTL $80–$300+.

Evolution benchmarks your SKUs against these ranges, then negotiates carrier tiers to help close any cost gaps.

Build SKU-Level Models (Not Averages)

Average orders hide pain and opportunity. Model by SKU clusters—velocity, size tier, return rate, and seasonality—then roll up to channel P&L.

Evolution Fulfillment’s analysts segment SKUs and reveal where FBA, MCF, or 3PL wins.

Velocity and Size-Tier Scenarios

Not all SKUs are created equal and they shouldn’t be modeled as if they are. Different product profiles behave very differently when it comes to fulfillment economics.

- Dense smalls (≤8 oz): Amazon FBA/MCF usually dominate thanks to their postage scale and fast shipping speeds.

- Standard-size (1–2 lb): Costs come down to packaging choices and zone distribution—sometimes Amazon wins, sometimes a 3PL does.

- Oversize or slow movers: Long-term storage fees and aged-inventory penalties can make Amazon prohibitively expensive. These SKUs are often better off in a 3PL/DC consolidation model or FBM setup.

- Kits and bundles: Pre-assembling kits reduces peak complexity. Amazon prefers pre-kitted SKUs because it keeps fulfillment smoother.

- Returns-intensive categories: Items like cosmetics or apparel typically benefit from a 3PL’s grading and refurbishment process, which can recover value and protect margins.

Time-in-Storage Sensitivity

Storage isn’t just about monthly costs it’s about how long inventory sits and where.

- Days on Hand (DOH): More days = higher storage allocations and more exposure to aged inventory fees.

- Aged penalties: Crossing Amazon’s 181/271/365+ day thresholds adds step costs that eat into margin.

- Safety stock complexity: Spreading stock across multiple FBA nodes raises aggregate inventory. In many cases, a single 3PL hub with strong 2-day coverage can cut that down significantly.

Packaging and Brand Experience Premiums

Packaging doesn’t just protect products it also shapes brand perception and customer retention.

- LTV/CVR lift: Branded unboxing and thoughtful inserts can boost conversion rates and repeat purchases.

- CAC payback: Prime’s 2-day delivery badge improves conversion—but branded packaging can offset CAC by strengthening loyalty.

- Returns moderation: Including guides, size charts, or “how-to” inserts reduces returns and lifts net margin.

At Evolution Fulfillment, we run A/B tests that measure the trade-offs between brand experience and speed, so you’re not guessing which path delivers the best ROI you’re working from real data.

Case-Modeled Comparisons: Amazon vs 3PL Economics

No single fulfillment model is universally cheaper. The right choice depends heavily on SKU profile, velocity, and returns behavior. Here are three modeled cases that highlight where Amazon vs a 3PL typically wins.

Case A: Small-Light, High Velocity (Prime-Native)

Assumptions: 8-oz small standard, 0.12 ft³, 20 DOH, apparel returns 12%, 80% Amazon / 20% DTC. Zones skew 4–7

- FBA: Storage ~$0.01; fulfillment ~$3.40; returns reserve ~$0.24.

- MCF for DTC: 2-day often $1.00–$2.00 below a comparable 3PL label.

- 3PL: Ops ~$3.25; postage ~$8.50; branded packaging +$0.35 with possible CVR lift. Outcome: FBA/MCF win on speed and scale. One Evolution client cut LCO by 11% (~$420k/year on 380k orders) by moving small‑lights to FBA/MCF while keeping branded kits in our 3PL.

Case B: Standard-Size, Medium Velocity (Mixed Channels)

Assumptions: 1.6 lb standard, 13″×9″×2″, 45 DOH, returns 8%, 50% Amazon / 50% DTC/wholesale.

- FBA: Storage pennies off‑peak; fulfillment ~$4.70.

- MCF 2-day for DTC: ~$9.30 typical.

- 3PL: Ops ~$3.75; mailer postage ~$8.10; insert $0.25; all‑in outbound ~$12.10. Outcome: Near tie after brand lift. An Evolution lifestyle client saw +2.4 pts CVR with branded unboxing, which offset higher 3PL ship costs on DTC while keeping Amazon orders in FBA.

Case C: Oversize / Slow-Moving or Kit Builds

Assumptions: 12 lb, 24″×16″×8″ (DIM 22 lb), 70 DOH, returns 4%, kits with 3 components.

- FBA: Storage and aged risk drive up LCO; outbound $16–$22.

- 3PL: Upstream DC storage ~$22/pallet/month; FBM ground ~$14.75; handling ~$4.50; pre‑kitting ~$0.80. Outcome: 3PL/DC beats FBA by $5–$9/order and avoids aged penalties. An Evolution housewares client reduced LCO 20% and freed $600k working capital by shifting oversize to our DC with carton optimization.

Cross-Border and Domestication Strategy

International expansion reshapes LCO. Duties/VAT, brokerage, and longer linehauls can erase postage savings. Decide per SKU whether to ship cross‑border DDP/DDU or domesticate into local stock.

Evolution Fulfillment operates bonded and domestic nodes to balance speed and cash.

Duties/VAT, IOR/EOR, and Transit Time Trade-Offs

- Duties/VAT: HS codes drive duty; VAT/GST adds at destination.

- IOR/EOR: Use your entity or a provider. Mismatches trigger holds and storage fees.

- Transit time: Cross-border small parcel adds 2–6 days. Slower delivery often reduces conversion more than you save on postage.

Domestication: When Local Fulfillment Wins

Local nodes reduce last-mile cost and improve SLAs:

- Lead time: 2-day ground is achievable domestically.

- Duty savings: Bulk import lowers per-unit brokerage; drawback can recover duties on returns.

- Returns ease: Local RMAs improve CX and reduce cost.

- Trade-off: Higher safety stock ties capital. Domesticate when weekly volume per SKU supports local stock and LCO drops by ~$1.00+ at target SLA.

Tools: Bonded Warehouses, Duty Deferral/Drawback

- Bonded warehouses: Store duty-unpaid until release. See a professional overview of the Canadian Customs Bonded Warehouse (CBW) concept from the Canadian Society of Customs Brokers.

- Duty deferral: Defer GST/VAT until sale to improve cash conversion.

- Drawback: Recover duties on re-exports or returns with documentation.

Evolution Fulfillment’s Vancouver bonded DC feeds Canadian FBA for Prime SKUs and ships DTC from our domestic node to avoid double taxation.

Hidden Costs and Constraints in Amazon Ecosystems

Beyond published fees, operational realities matter. Include inbound routing penalties, commingling risks, removal delays, and packaging limits in your model.

Inbound Routing Non-Compliance and Chargebacks

- Causes: ASN errors, label mismatches, missed appointments, mixed-SKU cartons.

- Prevention: Pre-ship audits, carton photos, barcode verification, routing checklists, buffer appointments.

Our pre-receipt checks reduced inbound defects by 0.5% for a client, saving ~$38k annually in rework and delays.

Commingling and Brand Control Risks

- Stickerless commingling: Pools identical ASINs across sellers and risks authenticity issues.

- Mitigation: Use FNSKU labeling for control and monitor Voice of the Customer.

Evolution Fulfillment manages FNSKU labeling in-house to keep your quality intact.

Removal Lead Times, Aged Inventory, and Capacity Limits

- Lead times: 2–6 weeks in peak. Aged fees accrue until exit.

- Capacity: FC storage limits and IPI scores cap inbound.

- Modeling: Allocate expected removal costs and cash-flow impact from longer pipelines.

We automate removal triggers and route returns to our DC before peak to avoid aged fees.

Packaging and Customization Limits

- Constraints: Limited custom boxes, inserts, gift wraps in FBA/MCF.

- Workarounds: Pre‑kit at a 3PL, use FBM for gifting SKUs, or MCF for speed plus “lite” branding.

Evolution Fulfillment runs dual‑SKU packaging strategies and routes by campaign.

Control vs Speed: When to Use FBA/MCF vs a 3PL

Use Amazon when speed/coverage drives conversion and your SKUs fit standard tiers. Use a 3PL when control, kitting, or oversize economics matter. Hybridize when your catalog spans both.

Choose Amazon When

- You need Prime badges/Buy Box and can maintain low-defect, high OTD metrics.

- SKUs are small/standard, under 18″ and <3 lb, low returns, and low kitting needs.

- You can avoid low-inventory-level fees with 28–40 days cover.

- You want 2-day national reach without deep carrier negotiations.

- You can live with limited packaging customization.

Choose 3PL When

- Custom packaging/inserts, kitting/subscriptions, or regulated SKUs require control.

- Oversize/fragile products benefit from carton optimization and specialized handling.

- You need unified B2C/B2B under one WMS with EDI/retail compliance.

- Cross-border domestication and bonded storage improve cash flow and LCO.

- You want brand-owned returns flows and refurbishment.

Evolution Fulfillment designs hybrids that deliver speed and brand together.

Adopt a Hybrid Fulfillment Strategy for Cross-Border Growth

A pragmatic hybrid maximizes speed where it pays and preserves brand where it matters. Anchor the operating model in a centralized 3PL spine, attach Amazon nodes for velocity SKUs, and use bonded/DC nodes for cross‑border.

SKU Role-Based Allocation

- High-velocity domestic: FBA for Amazon orders; MCF for non-Amazon when 2‑day speed lifts CVR.

- High-margin/brand-sensitive: 3PL/DC for custom packaging, gifting, and subscriptions.

- Regulated/oversize: 3PL with hazmat/oversize expertise and carton optimization; FBM on Amazon.

- Cross-border: Bonded/DC upstream, then release to local FBA/3PL for domesticated speed.

Inventory Pooling and Replenishment Rules

- Reorder points: Set by node. Avoid duplicating safety stock across FCs/DCs when a single 3PL hub can serve 2‑day to 80%+ of the population.

- Split allocations: Push A SKUs to FBA with 28–40 days cover; keep B/C SKUs at your 3PL and drip-feed to FBA as they promote.

- Avoid stranded stock: Reconcile FC capacity, IPI, and sell-through weekly. Automate removals back to your 3PL pre‑peak.

- Cross-border: Pool in bonded; release to local nodes when velocity thresholds are met.

Evolution Fulfillment runs these rules in your WMS/OMS with automated alerts.

Decision Matrix and Vendor-Selection Checklist

Score FBA/MCF vs 3PL vs hybrid on total cost-to-serve, SLA, cross-border readiness, and technology. Involve ops, finance, and ecommerce to weigh brand experience vs speed.

Scoring Criteria

- SLAs: OTD %, order accuracy, cut-off times, and peak surge capacity.

- Line-item TCO: Receiving, storage (time-weighted), pick/pack, packaging, outbound/DIM, returns, removals, aged fees, software, and account management.

- Cross-border: IOR/EOR, DDP/DDU handling, bonded/drawback experience.

- Tech stack: WMS/OMS/API, rate shopping, cartonization logic, channel integrations (Amazon SP‑API, Shopify).

- Scalability/footprint: Node coverage (US/Canada), 2‑day ground maps, FBA prep capability.

- Returns: Grading, refurbishment, secondary channels.

- References/compliance: Retail EDI, sustainability practices, social responsibility.

What Kind of Company Is a Fulfillment Company? (Capabilities to Expect)

A fulfillment company (3PL) receives, stores, picks, packs, and ships orders across channels (DTC, marketplaces, B2B). Expect:

- Services: Receiving, storage, pick/pack, packaging, kitting/assembly, FBA prep/removals, returns/refurbishment, B2B routing/EDI.

- Industries: Apparel/fashion (GOH, ticketing), cosmetics (lot/expiry), lifestyle/jewelry (security), pets/housewares (fragile handling).

- Compliance: Hazmat limits, retail chargeback prevention, customs paperwork.

- Integration maturity: APIs for Amazon/Shopify, EDI for retail, BI dashboards, cartonization/rate shopping.

Evolution Fulfillment delivers all of the above with Canadian and US coverage.

Scenario-Based TCO Modeling (12–24 Months)

Build a rolling 12–24 month model to compare FBA-only, 3PL-only, and hybrid. Include seasonality, peak surcharges, product launches, and cross-border shifts. Use SKU clusters, not averages.

Inputs, Outputs, and Stress Tests

- Inputs: Orders/day by channel, SKU mix, size/DIM tiers, return rates, days on hand, inbound cadence, peak volatility, zone distribution, cross-border lanes, duties/VAT, packaging standards.

- Stress tests: +20% peak surge, +2″ carton growth, +15 days dwell, carrier peak surcharges, MCF rate changes, FBA storage multipliers, removal delays.

- Outputs: LCO by SKU/channel, gross margin after fulfillment, working capital in pipeline, 2‑day coverage, Buy Box impact.

- Decision readouts: Winner by segment, hybrid policy, sensitivity tornado charts, cash‑flow impacts.

Sensitivity and Break-Even Analysis

- Storage days: +30 DOH can add $0.10–$0.50/order for standard; $1–$5 for oversize.

- Cartonization: Switching to mailers can save $1.50–$3.50 in DIM.

- Return rate: +5 pts in apparel adds ~$0.15–$0.25/order.

- Duty/VAT: A 5% duty swing on $40 customs value adds $2.00/order cross-border.

- Packaging complexity: +$0.50 custom packaging often requires ~1–2 pts CVR lift to break even at AOV $60.

- Break-even: For a 1.6 lb SKU, MCF 2-day at ~$9.30 beats a $8.10 3PL label only if Prime-like conversion adds ≥1.3 pts CVR.

Evolution Fulfillment builds these models and pressure-tests them with your live data.

Implementation Playbook: From Model to Live Operations

Translate the model into phased go-lives. Minimize risk, validate assumptions weekly, and lock cartonization/routing logic before scaling.

Integration and Data Readiness

- Catalog normalization: Harmonize SKUs/GTINs and bundle definitions.

- Barcoding: FNSKU/UPC strategy and scan tests.

- Cartonization logic: Accurate dimensions/weights; mailer eligibility flags.

- Routing guides: Inbound appointments, palletization, ASN templates.

- WMS/API checks: SP‑API permissions, order acknowledgments, cancel/hold flows, inventory sync (<15 min), exception alerts.

Phased Rollout and KPIs

- Pilot lanes: 1–2 SKUs per archetype; split DTC and Amazon to compare.

- A/B splits: Route a portion of DTC via MCF for 2‑day while maintaining branded 3PL for the rest.

- Weekly scorecards: OTD, accuracy, LCO variance vs model, storage days, return rate, Buy Box share, stranded stock, removal lead times.

- Exit criteria: ±5% LCO variance, ≥98.5% OTD, <0.8% defect rate, stable inventory sync.

Evolution Fulfillment manages pilots end‑to‑end and rolls winners into standard operating rhythm.

Evolution Fulfillment’s Brand Fulfillment Model (Blueprint)

Evolution Fulfillment operates as a centralized 3PL spine that integrates with FBA/MCF to balance speed, cost, and brand control. For mid-market brands in fashion, cosmetics, lifestyle, jewelry, pets, and housewares, we manage B2C and B2B under one WMS, orchestrate FBA prep and removals, and enable cross‑border domestication between the US and Canada.

Blueprint highlights:

- Centralized 3PL layer: Receive, store, kit, and ship DTC with branded packaging; handle wholesale/EDI; manage returns grading and refurbishment.

- Amazon interlock: Feed FBA with compliant prep/labeling; pull aged/stranded stock back via removals; use MCF selectively for 2‑day DTC where branding constraints are acceptable.

- Cross-border optimization: Bonded/DC nodes to defer duties, avoid double taxation, and domesticate high-velocity SKUs; duty drawback workflows for returns.

- Tech spine: WMS/API integrations to Amazon SP‑API, Shopify, and retail EDI; cartonization/rate shopping; SKU‑level profitability dashboards.

Results: A cosmetics brand achieved a 20% efficiency gain and $1.1M annual savings by shifting oversize and kits to our DC, keeping small‑lights in FBA/MCF, and domesticating Canada via bonded release.

Quick Answers to Related Questions

What services does a fulfillment company provide?

A fulfillment company (3PL) receives inventory, stores it, picks and packs orders, and ships via parcel/LTL. It also offers packaging, kitting/assembly, FBA prep/removals, returns processing and refurbishment, wholesale/EDI compliance, and cross‑border support (IOR/EOR, brokerage). Mature providers add WMS/OMS integrations, cartonization/rate shopping, BI dashboards, and retail chargeback prevention. For terminology around DC/warehouse roles and flows, see BCIT’s warehouse/DC overview.

When should I use Amazon FBA vs a third-party 3PL?

Use FBA for small/standard, high-velocity SKUs where Prime speed boosts conversion and packaging constraints are acceptable. Use a 3PL when you need branded unboxing, inserts, kitting/subscriptions, regulated/oversize handling, unified B2C/B2B, or cross‑border domestication. Many brands run a hybrid: FBA for A SKUs, 3PL for brand‑critical and oversize, and MCF for 2‑day DTC where it pencils.

What are typical setup, storage, and pick-pack rates for 3PLs?

Setup: $0–$5,000 (integrations $0–$500/connector). Storage: $15–$35/pallet/month or $0.50–$1.20/ft³, with Q4 surcharges. Pick/pack: $2.00–$3.50 first pick; $0.25–$0.75 add-ons; packaging $0.12–$1.20. Ranges vary by region, season, and volume—validate with live quotes.

Conclusion

Mid-market brands that map activities to fees, model SKU-level landed cost per order, and segment by velocity, size, and returns make better fulfillment choices. The practical trade-off is control versus speed. Use FBA/MCF for Prime-native, postage‑dense SKUs. Use a 3PL spine for branded packaging, kitting, oversize, and cross‑border domestication.

At Evolution Fulfillment, we operationalize hybrids that protect margin and elevate your brand. Ready to build a Canada‑ready, cost‑effective fulfillment spine?

Explore Evolution Fulfillment’s Canada warehouse and fulfillment services: https://evolutionfulfillment.com/fulfillment-services/warehouse-in-canada